The Institute of Chartered Accountants of India (ICAI) has recently introduced a new system called UDIN, which stands for Unique Document Identification Number. This system is aimed at enhancing the credibility and authenticity of documents certified by chartered accountants (CAs), and reducing the instances of fraudulent practices.

With the implementation of UDIN, CAs are required to generate a unique identification number for each document they certify or attest to. This number is then registered on the ICAI portal, making it easily accessible and verifiable by any interested party. The UDIN system also enables tracking of all documents certified by an individual CA, ensuring accountability and transparency in their professional work.

UDIN ICAI Login 2023

UDIN, or the Unique Document Identification Number, is a new system implemented by the Institute of Chartered Accountants of India (ICAI) to ensure authenticity and traceability of financial documents. The aim is to prevent any fraudulent activity in the submission and handling of these documents.

The UDIN system generates a unique code for each document, which can be verified by anyone through the UDIN portal provided by ICAI. It applies to all types of certificates issued by CAs such as tax audit reports, financial statements, GST returns, etc. Additionally, it is mandatory for all CAs in practice to generate a UDIN for every document they sign or certify.

To generate a UDIN, CAs need to register themselves on the ICAI portal and provide details like name, membership number and date of birth.

Function of UDIN ICAI Portal

- The Unique Document Identification Number (UDIN) ICAI portal is an initiative by the Institute of Chartered Accountants of India (ICAI) to provide a digital signature to all attested documents.

- The UDIN system was implemented on July 1, 2018, and has since become mandatory for all practicing chartered accountants.

- It serves as proof that the document has been signed by a certified professional and helps prevent fraudulent activities.

- This innovative system provides a secure way to validate professional certificates and other significant documents.

- Through this portal, chartered accountants can easily generate UDINs for their clients’ financial statements, tax returns, audit reports, and other attestations.

- The validity period of each UDIN is restricted to 25 years after which it expires automatically.

Services provided by UDIN ICAI Portal

The UDIN ICAI portal provides various services to its members, including generating UDINs for their documents and verifying the authenticity of other members’ documents.

- One of the primary services offered by the UDIN ICAI portal is generating a unique identification number for all financial documents submitted by chartered accountants.

- This ensures that every document can be traced back to its originator and helps prevent the misuse of such documents.

- Members can generate UDINs for different types of financial statements, reports, certificates, etc., using this portal.

- Additionally, members can also use this portal to verify the authenticity of other members’ documents that contain a UDIN.

UDIN Registration

UDIN registration is mandatory for all Chartered Accountants in India as per the directives of the Institute of Chartered Accountants of India (ICAI).

- To apply for UDIN registration, one must have an active membership with ICAI.

- Once registered, one can generate a UDIN for each document that they sign or attest to.

- The process of generating a UDIN involves logging into the UDIN portal, entering relevant details about the document such as its type, date, client name, etc., and uploading it onto the portal.

- It is important to note that every document must have its own unique UDIN and should not be shared with any other document.

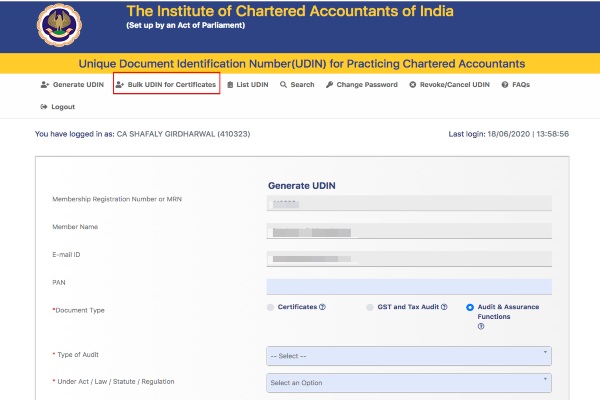

How to login UDIN ICAI?

To login into UDIN, you need to follow some simple steps.

- Firstly, visit the official website of UDIN – www.udin.icai.org.

- Then click on ‘Login’ at the top right corner of the homepage.

- Enter your credentials like your username and password as registered with ICAI’s portal and click on ‘Log In’.

- After successful login, you will be directed to your dashboard where you can view all details related to UDIN.

How to Generate UDIN ICAI for your Documents or Certificate?

As per the Institute of Chartered Accountants of India (ICAI), all documents or certificates issued by its members after February 1, 2019 must have a unique Document Identification Number (UDIN) for authenticity and transparency. UDIN is a 16-digit alphanumeric number that can be generated online by the chartered accountants to verify the genuineness of any document. If you’re an ICAI member and want to know how to generate UDIN for your documents or certificates, this article will guide you through the simple steps.

- Firstly, log in to your ICAI account with your registered User ID and password.

- Then go to the ‘UDIN Generation’ tab on the home page and click on ‘Generate UDIN.’

- Next, choose whether you want to generate it for an original document or a certified copy.