Traces is TDS Reconciliation Analysis and Correction Enabling System. TRACES is the official website of the Income Tax Department that holds the stakeholders to get involved in any Administration and implementation activities related to TDS. The full form of TDS is a tax deduction source and the full form of TCS is a tax collected at the source. In this article, we are going to inform you about how to download form 16a from traces, 26as from traces login and how to file tds return online.

This official incometaxindiaefiling.gov.in portal is for all the taxpayers that allow them to pay their tax with the help of this official website of traces. TDS traces is a useful portal for downloading and viewing your important documents related to taxes like form 16 and form 16A and form 16 download, 26as traces, etc.

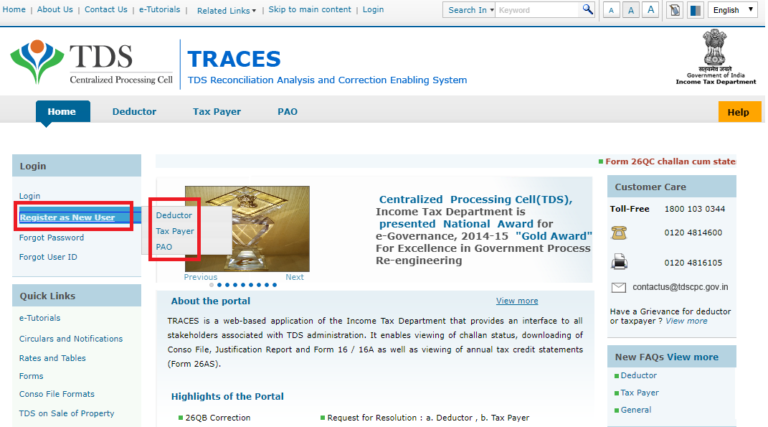

How to register on traces

You will able to access all the services provided by the traces portal but first, you need to register yourself for TDS reconciliation analyzing and correction enabling system for taxpayer and deductor. If you want to know how to register to traces TDS portal then read the steps which are mentioned below.

- Visit the official website -> https //127.0.0.1 traces.

- Click on the registration option.

- Select register as deductor or taxpayer for the PAO option.

- Enter your pan card number date of birth and date of Incorporation.

- Enter the name of the taxpayer.

- Enter the details of TDS deduction and collection.

- Enter the detail of the challan used to deposit the tax.

- Enter the detail of the 26qb statement.

- Click on create account option.

- Now click on the edit button to edit your profile.

- Click on submit button. After successful submission, you will receive a confirmation SMS on your registered mobile number or Email for activation code.

How to login

- Visit the official website tdscpc login.

- Click on the login button.

- Select login as deductor or taxpayer option.

- Enter the user ID.

- Now enter the password.

- Enter TAN for deductor. Click on the login button.

How to recover forgotten password

- Visit the official website tds login.

- Click on forgot password option.

- Select the type of user as a deductor, taxpayer, or PAO.

- Click on proceed option.

- Enter the username.

- Enter TAN of deductor.

- Enter token number.

- Enter TAN registration number.

- confirm the captcha code and click on proceed button.

How to recover forgot deductor user ID

- Visit the official website.

- Click on forgot user ID option.

- Enter Tan of deductor.

- Enter verification code.

- Confirm the captcha code.

- Click on proceed button.

What is a traces portal?

Traces TDS is an online web portal that handles all the income tax-related activities with the help of their website. This portal provides benefits to all the income taxpayers and helps them to save their time and money with the help of this digital platform traces. With the help of this portal, you will easily access any kind of income tax-related services by sitting home. You can access all your Income Tax details via vsisiti8ngwebsite. As we all know due to coronavirus people start avoiding going to any government offices. As the income tax payer, everyone hates to go to Income Tax officers every time if they want to know anything about their tax deductions. With the help of this portal you don’t have to go anywhere you just simply able to access your TDS with the help of your mobile or PC.

Uses of traces

This TDS traces website is for all the taxpayers around the country which helps them to avail themselves various services which they can access while sitting at home.

- Helps to download and view form 26as.

- If you want to know about your Challan status then you will able to do so by visiting this official traces portal.

- You will able to check various tax statements online.

- You will able to submit any kind of refund request online.

- Submit online TDS and TCS statement correction forms.

- Download any consolidated files and justification report form 16 and 16A as for all TDS deductors.

- Submit correction request of TDS challan online.

- Submit a request for online correction of the previous year of TDS return.

This official portal is for all taxpayers which helps them to carry out a wide range of activities related to the Income Tax Department. This portal also helps the income tax officials to get rid of any kind of paper-based system which consumes a lot of time and money. With the help of this digital platform, you will able to access your online TDS details.

Traces customer care

- The toll-free number of TDS traces is 1800 103 034 4.

- It wants to know about any queries related to your TDS tax deduction then you need to contact the customer care number which is 12048 14600.

- You can also contact the traces customer care by mail which is contact@tdscpc.org.gov.in.

Key features of traces website

- With the help of TRACES, you will able to access the dashboard which provides you all the details related to the tax deduction account.

- Grievance registration and resolution process.

- View form 26as.

- Online filing of TDS statement.

- Online correction of TDS statement

- Online registration of TDS and collectors account number.

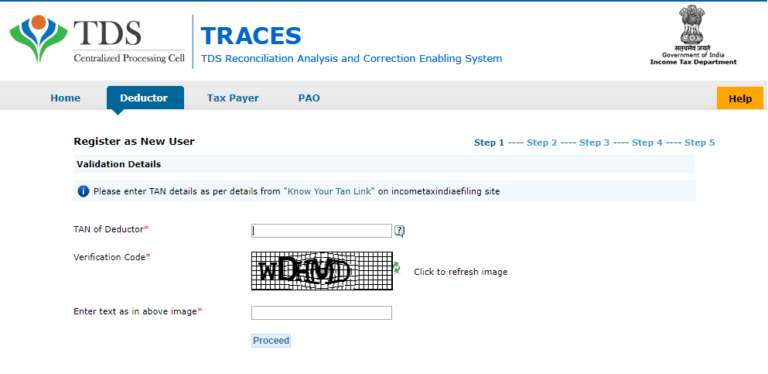

How to register on traces by deductor

- Visit the official website traces login nri.

- Click on the register as a new user option.

- Select the deductor option.

- Provide the registration details by the deductor.

- Click on submit button online registration process.

- After the successful registration, an activation code will be sent to your registered mobile number or Email address.

- Click on the activation code and enter your user id and activation code as a password.

Traces Tax deductor Services

Tax deductor is a particular body or a person who is entitled to tax deduction at the source in a very specific and particular payment mode. The payment of tax is deducted by the TDS director with the help of the TDS machine that will deposit Tax amount in the income tax department. The tax deductor is also responsible to submit the report of the tax deduction statement to the Income Tax Department. Following is the list of individuals who are required to mandatory record the TDS statement.

- Companies authorized by the government.

- Government offices.

- Individual who is required to get account audited under section 44ab of Income Tax Act 1961.

- It is mandatory for all the deductors to record more than 20 deduction reports in the particular quarter of the financial year.

Key activities related to TDS tax deductor on traces

- Provide feedback.

- View statement status.

- Offline correction.

- Download justification report.

- TDS refund.

- Declaration of non-filing of the statement first off validate 197 certificates.

- Online correction.

- Connection of sub-users by admin users.

- View Challan status.

- Manage user profile and change password.

- Registration of admin users for GST.

- Download forms 16 and 16A.

- View TDS and TCS credit for PAN card.

What is the traces justification report?

The justification report includes all the details like the default error which is identified by Income Tax Department. The justification report includes details that are important for income tax. This justification report is a statement that is filed by the Income Tax director on a quarterly basis of the financial year. The justification report provides all the details and important information related to errors and faults that need to rectify by the director. This rectification process can be done by filing the collect information on the Income Tax statement along with interest and fees with other dues which is mandatory applicable in this report. This report is used by the director that helps them to provide information of clarification and other false identified by tax authorities.

What is form 16 and 16A download?

Traces portal help the deductor to fill the form 16 and 16A. This form contains various records of TDS and helps the taxpayer to file the income tax support. According to section 19 A this is issued on the basis of tax deduction by the employer on behalf of their employee. This form is issued on the basis of the salary income of the employee. If there is any provision then-employer needs to issue form 16a under tax deduction.

Admin user role on traces

Admin user role is created when Tan number is already registered on the official portal of traces. This TAN number is registered by the surrender to the assigned officer.

What is the sub-user role?

The sub-user role is created by the admin while registering on traces. Every admin creates a minimum of 4 users’ specific Tan number. Some users can easily be deleted by the admin anytime but however when the sub-user is deleted then all the details related to that some user will also be deleted from the server of tracers. After that admin needs to add all the sub-user information again for the system activation process.

What is traces portal services for taxpayers?

A taxpayer is a person or an organization who is liable to pay tax to the government. This person who is liable to pay tax will able to register on the traces portal for depositing their taxes. Following are the services which are provided by the traces portal to all the taxpayers.

- Registration for form download on 26a.

- A download of form 16b.

- Manage user profile change and recover TDS traces password.

- Verify TDS Certificate.

- View and Download TDS compliance report.

Traces form 26as

When you register to the traces portal you will able to give your tax credit which is also known as form 26a as. With the help of this tax, the deductor will able to record the following details.

- deduction on behalf of the taxpayer.

- Details of tax collected on behalf of the taxpayer by the tax collector.

- Details of tax deducted on the same of immovable property.

- Refund which is received during the financial year.

- TDS default-related statement.

- Advance tax or self-assessment tax.

- Regular assessment tax.

- Details of transactions in mutual fund shares and bonds.

PAO services offered by TDS traces

Pay and account office is the Income-Tax branch which manages all the Payment Record of various Government employees. Drawing and disbursing officer is work under the administration of pay and account office. DDO is an official person who is authorised by the government to draw a sum of money which is related to the kind of payment against the assessment account and credit account which is open by the government in favour of a specific branch of the Finance Bank. The DDO required to file form 24g for the specific authority under the general director of the Income Tax Department within the time duration of 10 days. Following are the key service provided for pay and account officers on the traces portal.

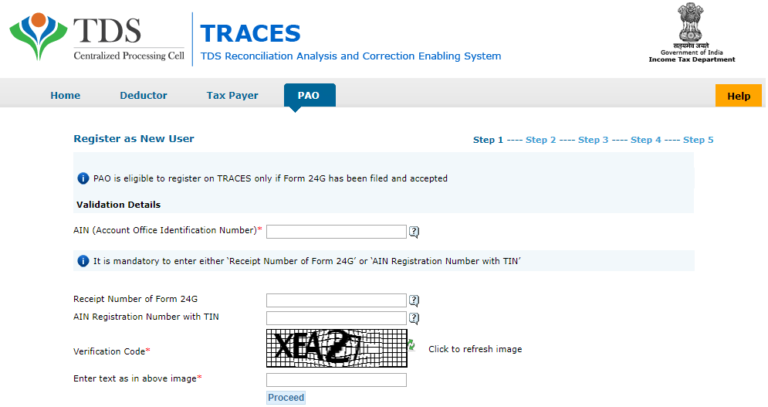

How to register for traces under PAO

- Visit the official website.

- Click on the login to traces button.

- Click on registered as a new option.

- Click on p a o option.

- Enter your required details in the registration form.

- Click on submit button to confirm the details.

- An activation code will be sent to your registered mobile number or Email Id.

- Select the activation code for successful registration.

How to do correction in TDS TCS statement

If you want to do some correction and your TDS and TCS statement then read the star which is mentioned below.

- Visit the official website traces 26as login.

- Click on the correction option.

- select form type.

- Enter accept the token number.

- Select the online category option.

- Click on the track correction option.

- When the status becomes available click on the available option.

- Enter your KYC information.

- Select challan correction type category.

- Enter the connection details and click on submit button.

- After that, a 15 digit token number will be sent to your registered mobile number.

Online correction service status check

Following are the options which are available through online status in the traces portal.

Request: When the file is submitted successfully for the request of correction.

Initiated: When the request has been proceeding to CPC.

Available: When the request has been accepted so its user can now start correctly in the statement.

Failure: When the correction request cannot be processed due to some technical reasons.

In progress: It means that the request has been processing.

Submit to admin: It means that the request has been sending to the admin for correction.

Rejected: It means the request of correction has been rejected by TDS CPC.

TDS compliance report

- Visit the official website.

- Click on the deposit base option.

- Now select your option.

- Select a relevant financial year.

- Fill in all your necessary details.

- Click on submit button.

- When the request is successfully submitted then an excel file will be opened and the request download link will be available under the download option.

Tds certificate download

- Enter User ID and Password

- Click on login.

- Click the Download Button.

- Choose Form 16A.

- Fill in all details and click the go button.

- Click the Submit Button.

- Enter Details and click the submit button.

- Enter Details and click Proceed With Transaction.

How can I check my TDS certificate online?

- Visit www.tdscpc.gov.in/app/tapn/tdstcscredit.xhtml.

- Enter the verification code.

- Click on ‘Proceed’

- Enter the PAN and TAN.

- Select the financial year with the quarter and the type of return.

- Click on ‘Go’ button

- The details will be shown on the screen.

Is TDS certificate mandatory?

According to section 203 of the income tax act, 1961 it is mandatory for all the detectors to deduct TDS.

Above we have given information for https //127.0.0.1 traces, efillingincometax, form 26qb, traces website, tds challan status, payment online, how to download form 16a from traces, & tdscpc login etc.

Also check: dfccil login