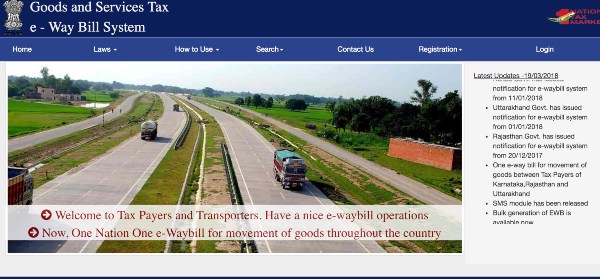

The eway bill is an important document for businesses in India to facilitate the transportation of goods. The Indian Government has launched an online portal which allows users to get registered and login to generate this document. This article aims to review the eway bill login portal, describing its features, benefits, and how it can be used. With this new platform, customers can quickly and securely access their eway bill anywhere and anytime with just a few clicks of a button.

e way bill generation

The eway bill login portal is an online platform created by the Government of India for businesses to file tax returns and comply with GST regulations. It is a secure website that allows GST registered taxpayers to access their e-invoices, view the status of their taxes, and generate reports. With this portal, users can manage their accounts easily and quickly, making it simpler for them to stay compliant with the latest tax laws.

The portal also provides GST-registered taxpayers with all the necessary information they need to file their taxes accurately. This includes details about applicable taxes as well as forms needed for filing returns or making payments. In addition, business owners can also find out whether they are eligible for any exemptions or concessions under GST laws.

Objectives of e way bill login portal

- The e-way bill login portal is an online platform created by the Indian Goods and Service Tax (GST) Council to help facilitate the inter-state movement of goods.

- This digital platform streamlines the paperwork involved in transporting goods from one state to another, helping businesses save time and money.

- It is a mandatory document required for all inter-state transactions of goods valued at more than Rs 50,000.

- The objectives behind creating this portal are twofold: first, it streamlines the process of obtaining and recording e-way bills; second, it makes filing GST returns easier by providing a single platform for doing so.

- Additionally, since all information related to GST payments can be accessed through this portal, it reduces the likelihood of tax evasion or incorrect declaration of taxable income.

- Furthermore, businesses can access their records in real time instead of waiting for manual processing to generate reports.

Features of e way bill login portal

- The electronic way bill (e-way bill) login portal is a resourceful platform for Indian taxpayers.

- It allows them to conveniently access the e-way bill system and generate documents necessary for inter-state movement of goods.

- The portal consists of various features, which makes it a helpful tool for businesses.

- To begin with, the e-way bill login portal enables users to register themselves on the system and create their own account by providing personal information such as name, mobile number, business details etc.

- This makes it easy for users to log in with their credentials and access all the features offered by the portal.

- Additionally, businesses can add multiple GSTINs (Goods & Service Tax Identification Number) onto their account and use them as required.

How to Generate E-Way Bill

Generating an E-way bill can seem like a daunting task, but it doesn’t have to be. An E-way bill is required by the Indian government for all businesses moving goods worth more than Rs 50,000. This article will guide you through each step of generating an E-way bill in order to ensure that you meet the requirements of the law and stay compliant with regulations.

- The first step to generate an E-way bill is to register as a taxpayer on the Goods and Services Tax (GST) Network portal.

- Once registered, you can use your GSTIN or Goods and Service Tax Identification Number to create your e-Way Bill portal ID.

- Next, log in to the portal using your credentials and fill out Form EWB-01 with details such as transporter information and invoice/bill number before submitting it for generation of the e-Way Bill.

E-Way Bill Portal Login

Logging into the e-way bill portal is an important part of filing taxes and ensuring compliance with government regulations. It’s a simple process that can be completed in just a few steps. Here’s how to login through the E-Way Bill portal:

- First, you’ll need to access the e way bill registration website.

- You can do so either by entering the URL directly or using your favorite search engine to find it.

- Once you’re on the site, click on “Login” at the top right corner of the homepage.

- This will take you to a new page where you’ll be asked for your credentials – this includes your e way bill login id password that were issued when registering for an account with the E-Way Bill portal.